Education is like a delicious cake – everyone wants a slice, but sometimes the price is too high! Thanks to the recent education GST tax cut, students and parents can finally breathe easier (and maybe even save some money for snacks during study sessions ).

In India, education is provided by public and private sectors, and the government’s main goal has always been affordable learning. With GST on education being adjusted, both students and institutions are feeling the sweet relief. Let’s break it down in simple terms – without confusing tax jargon.

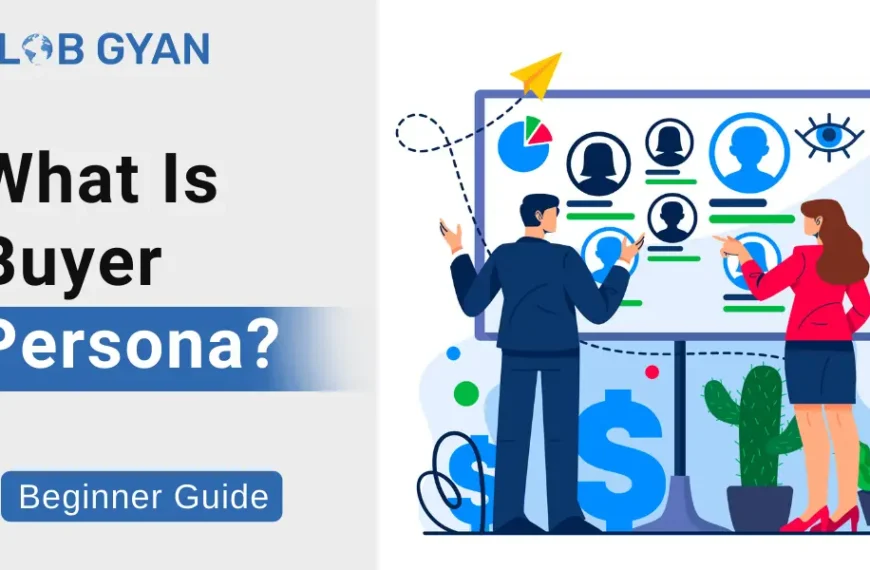

1. What is GST and Why Does it Matter in Education?

GST (Goods and Services Tax) is India’s one-stop tax system that replaced multiple indirect taxes. Think of it as a “tax buffet” where everything is under one roof instead of paying separately for every dish!

Why GST matters in education:

- Ensures students are not paying double taxes

- Regulates gst on educational services like tuition fees, online courses, and coaching institutes

- Helps institutions manage costs efficiently

Pro Tip: If your child asks why they have to pay more for online classes, now you can blame it on previous GST rates!

2. GST on Educational Services: Before vs After Tax Cut

Let’s look at a simple table to understand how education GST tax has changed:

| Service Type | Previous GST Rate | Current GST Rate | Impact on Students/Institutions |

| Coaching Institutes | 18% | 5% (for certain courses) | Cheaper coaching, better access |

| Online Courses / E-learning | 18% | 5–12% | Affordable digital learning |

| Preschools to Higher Secondary | 0% | 0% | Still exempted – no extra burden |

| Non-academic Supplies (Stationery, Uniforms) | 18% | 12% | Slightly cheaper materials |

| Excursions & Trips | 18% | 12% | Reduced cost, fun trips more affordable |

Takeaway: The lower GST on educational services means students get quality education without parents breaking the bank.

3. How Lower GST Benefits Students and Institutions

- Affordable Learning:

Tuition, online courses and study materials cost less, so parents don’t have to sell their kidney just kidding! But really, savings are significant. - Wider Accessibility:

Students from rural areas or low-income families can now enroll in quality programs. - Boost for Ed-Tech Companies:

Online learning platforms can reduce fees, making education more competitive and innovative. - Institutional Growth:

Schools, coaching centers, and universities can reinvest savings into infrastructure, digital tools, and better teachers.

4. Exempted vs Non-Exempted Educational Services

Exempted under GST

- 1. Examination fees & assessments

Examination and assessment fees are fully exempted under GST. This means schools and coaching institutes do not charge extra taxes for conducting exams or evaluating students. Parents and students pay only the actual fee, making it more affordable to assess academic performance regularly without worrying about hidden costs. - 2. Curriculum-related materials

Books, study guides and other materials directly related to the course curriculum are exempted. Students can purchase essential learning resources without paying GST, which reduces the overall cost of education. This ensures that learning materials remain affordable and accessible to all students, especially those in public schools. - 3. Course-related trips (excluding accommodation & food)

Field trips, educational excursions, and other curriculum-linked travel are exempt from GST on the educational component. However, any accommodation or food charges during the trip are still taxable. This exemption encourages practical learning experiences without adding extra financial burden for the educational activities themselves. - 4. Administrative services (registration, student cards, transcripts)

Services like student registration, issuing or replacing ID cards, printing transcripts and paying late fees are exempt from GST. Schools and colleges cannot add extra tax to these essential administrative tasks, ensuring that small but necessary services do not increase costs for students or their families. - Non-Exempted under GST

- 1. Coaching institutes & training programs

Private coaching classes and training programs not directly part of formal schooling are taxable under GST. Fees for entrance exam preparation, skill development, or competitive exams include taxes. This adds a small cost for parents but is necessary for managing revenue from third-party training providers. - 2. Excursion food & accommodation

While the educational part of field trips is exempt, any meals or lodging provided during excursions are subject to GST. This ensures that services provided by third parties, like hotels or catering, contribute tax revenue. Students and parents should budget for these extra costs during trips. - 3. Non-academic supplies (computers, uniforms, sports kits)

Items that are not directly part of academic learning, such as computers, stationery, uniforms, sports kits and musical instruments, are taxable. Schools cannot provide these without including GST. This slightly increases the cost for families, even though these items are necessary for overall student development.

Quick Analysis:

The education GST tax cut benefits most core services, making tuition and curriculum costs more affordable. Non-academic services and coaching programs still incur taxes, so students and parents may face minor additional expenses in these areas..

5. New GST Rates: Items Reduced from 12% to 5% and Zero Tax

Items Reduced from 12% to 5% GST

| Item / Product | Old GST | New GST |

| Geometry Box | 12% | 5% |

| Mathematical Box | 12% | 5% |

| Color Box | 12% | 5% |

| School Bag | 12% | 5% |

| Tiffin Box | 12% | 5% |

| Pencil Box | 12% | 5% |

| Pencils & Small Items | 12% | 5% |

| Eraser (Rubber) | 12% | 5% |

| Sharpener | 12% | 5% |

| Charcoal Pencil | 12% | 5% |

| Sketch Pen | 12% | 5% |

| Drawing Book | 12% | 5% |

| Notebooks (Uncoated Paper/Paperboard) | 18% | 12% |

Items Reduced from 12% to Zero (0%) GST

| Item / Product | Old GST | New GST |

| Large Writing Copy | 12% | 0% |

| Exercise Book | 12% | 0% |

| Graph Book | 12% | 0% |

| Lab Notebook | 12% | 0% |

6. Essay on GST: Simplified Version for Students

For anyone writing an essay on GST, here’s a simple explanation:

“GST (Goods and Services Tax) is a single tax system that replaced multiple indirect taxes in India. It ensures no double taxation and regulates the cost of goods and services. The recent reduction in GST on educational services has made learning more affordable, benefiting students, parents, and institutions.”

Tip:Mention online courses and school fees.

7. PM Modi’s Diwali Special GST: The Cherry on Top

During the festive season, the government announced PM Modi’s Diwali Special GST, which further reduced GST rates on select educational services. This initiative:

- Encourages students to pursue education without worrying about extra costs

- Supports private institutions to maintain quality while offering affordable fees

- Reinforces India’s commitment to making education accessible to all

Conclusion

The education GST tax cut has made education more affordable, benefiting students, parents, and institutions alike. Coaching institutes and non-academic supplies remain partially taxed, but the overall impact is positive.

For entrepreneurs and educational businesses, this is a golden opportunity. Platforms like GroxDigital help you leverage these reforms to grow your business while providing students with affordable learning opportunities.